Australian Expat Tax Advice & Returns

As a non-resident for Australian tax purposes you will be required to lodge an Australian tax return with the Australian Taxation Office (ATO) to report your Australian sourced income & gains.

Should you have an outstanding HELP debt then you are also required to report your overseas earnings on an Australian tax return and make any repayments due.

Your income is taxed at non-resident rates of tax (32.5% on the first $120,000 (2022/2023) and you are not entitled to the tax free threshold ($18,200 for 2022/2023).

The Australian tax year runs from 1st July to 30th June.

You will need to apply for a tax file number (TFN) in order to lodge an Australian tax return if you do not already have a TFN and you have an obligation to lodge.

If you are working overseas for an Australian employer your income may need to be reported differently.

Firstly you will need to determine if your income is taxable in Australia or/and in the country to which you services are being performed.

Earnings are considered foreign when the work is performed overseas.

Secondly, depending on the length of time spent outside of Australia you will need to consider whether you are still considered to be an Australian Tax Resident.

Your tax residency is fundamental to determine who has taxing rights over your worldwide income with particular reference to the salary being paid to you.

Your residency is often a significant issue, as residents of Australia are subject to income tax on their worldwide income and non-residents are only taxable on their Australian sourced income subject to the exempted income provisions.

It is possible to be a dual resident with the overseas country and Australia. Should this be the case you would need to consider which country has overriding residency which is commonly referred to as treaty residency as it is the conditions set in the double taxation agreement which would determine this deciding point.

Once your residency position has been determined you can better understand who has taxing rights over your income along with your tax reporting obligations in both countries.

When considering an overseas secondment to the United Kingdom you must first give consideration as to what your tax implications are in the UK and the country you are leaving.

The questions to consider:

How long is the secondment for?

Is your family to travel with you, or remain behind?

Will I remain a tax resident in my country of residence?

Will I continue to remain an employee of my current employer?

Am I to transfer to the overseas employing office and if so, what are the terms?

Will I be a UK tax resident, if so am I eligible to claim split year treatment?

Do I qualify for the Remittance Basis of accounting?

Does the UK have a double taxation agreement with my country of residence?

Your tax residency is fundamental to determine who has taxing rights over your worldwide income with particular reference to the salary being offered to you.

Your residency is often a significant issue, as residents of the UK are subject to income tax on their worldwide income, unless remittance basis claimed and non-residents are only taxable on their UK sourced income subject to the exempted income provisions.

It is possible to be a dual resident with the overseas country and the UK. Should this be the case you would need to consider which country has overriding residency which is commonly referred to as treaty residency as it is the conditions set in the double taxation agreement which would determine this deciding point.

Once your residency position has been determined you can better understand who has taxing rights over your income along with your tax reporting obligations in both countries.

As a non-resident for Australian tax purposes you will be required to lodge an Australian tax return with the Australian Taxation Office (ATO) to report your Australian sourced income & gains.

Your income is taxed at non-resident rates of tax (32.5% on the first $120,000 (2022/2023) and you are not entitled to the tax free threshold ($18,200 for 2022/2023).

The Australian tax year runs from 1st July to 30th June.

You will need to apply for a tax file number in order to lodge an Australian Tax Return if you do not already have a TFN and you have an obligation to lodge.

Should you have an outstanding HELP debt then you are also required to report your overseas earnings on an Australian tax return and make any repayments due.

As a non-resident for Australian tax purposes living in Hong Kong you will be required to lodge an Australian tax return with the Australian Taxation Office (ATO) to report your Australian sourced income & gains.

Should you have an outstanding HELP debt then you are also required to report your overseas earnings on an Australian tax return and make any repayments due.

Your income is taxed at non-resident rates of tax (32.5% on the first $120,000 (2022/2023)and you are not entitled to the tax free threshold ($18,200 for (2022/2023).

The Australian tax year runs from 1st July to 30th June.

You will need to apply for a tax file number in order to lodge an Australian Tax Return if you do not already have a TFN and you have an obligation to lodge.

As a non-resident for Australian tax purposes you will be required to lodge an Australian tax return with the Australian Taxation Office (ATO) to report your Australian sourced income & gains.

Your income is taxed at non-resident rates of tax (32.5% on the first $120,000 (2022/2023)and you are not entitled to the tax free threshold ($18,200 for 2022/2023).

The Australian tax year runs from 1st July to 30th June.

You will need to apply for a tax file number in order to lodge an Australian Tax Return if you do not already have a TFN and you have an obligation to lodge.

Should you have an outstanding HELP debt then you are also required to report your overseas earnings on an Australian tax return and make any repayments due.

Establishing your Australian tax residency status

If you are leaving Australia to go live and work overseas for a period of time it is important that you obtain professional tax advice in relation to your Australian tax residency position and the impact this may have on your future reporting and ongoing tax implications.

There are a number of tests to best determine your residency position which are detailed below:

Resides Test

The primary test of tax residency is called the resides test. If you reside in Australia, you are considered an Australian resident for tax purposes and you do not need to apply any of the other residency tests.

Some of the factors that can be used to determine residency status include:

- physical presence

- intention and purpose

- family

- business or employment ties

- maintenance and location of assets

- social and living arrangements

There Are Several Aspects of The Resides Test

What does it mean to ‘reside‘ – “to dwell permanently, or for a considerable time, to have one’s settled or usual abode, to live, in or at a particular place”

Behaviour while in Australia, what is your intention & purpose?

Domicile Test

You are an Australian tax resident if your domicile (the place that is your permanent home) is in Australia, unless your permanent place of abode is outside of Australia.

A domicile is a place that is considered to be your permanent home by law. For example, it may be a domicile by origin (where you were born) or by choice (where you have changed your home with the intent of making it permanent).

There are two steps to this test:

Determine your domicile

If not in Australia, the domicile test is not satisfied.

If in Australia, go to step two.

Determine your permanent place of abode

- If not in Australia, the domicile test is not satisfied.

- If in Australia, you are considered an Australian resident for income tax purposes.

183 Day Test is the Second Statutory Test

This test only applies to individuals arriving in Australia. You will be a tax resident of Australia under this test if you are physically present in Australia for more than half the income year, whether continuously or with breaks.

Under this test, you may be said to have a constructive residence in Australia unless it can be established that:

your usual place of abode is outside Australia

you have no intention to take up residence here.

In this test, your usual place of abode must be outside of Australia. This is different to the first test (domicile) that requires us to be satisfied that your permanent place of abode is outside Australia.

Commonwealth Superannuation Test is the Third Statutory Test

If you as a Australian government employee, you are considered a resident of Australia for tax purposes, even if you live outside the country. This applies to employees who contribute to certain public sector superannuation schemes.

Under the Commonwealth superannuation test, you are an Australian tax resident if you are a contributing member of:

the Public Sector Superannuation Scheme (PSS), or

the Commonwealth Superannuation Scheme (CSS).

This test does not apply if you are a member of the Public Sector Superannuation Accumulation Plan (PSSAP).

If you are an Australian resident under either of these this tests, your spouse and any children under 16 years old are also Australian residents for tax purposes.

If declared an Australian tax resident

You must prepare a Tax Return and declare your worldwide income regardless of whether any income is remitted to Australia.

If declared a Australian non-resident for tax purposes

You must prepare a Tax Return and declare your Australian sourced income along with overseas sourced income if the event of a HELP debt and unfranked distributions.

Australian expat tax return overview

The financial year runs from 1st July to the following 30th June.

Non-resident tax returns are only required in relation to Australian sourced income only and certain dividend distributions along with foreign sourced income due to HELP reporting purposes only.

Australian citizenship does not affect your residency position.

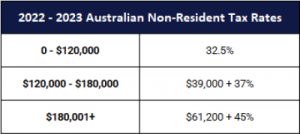

2022-2023 Australian tax rates for non-residents

0 – $120,000 32.5%

$120,000 – $180,000 $39,000 + 37%

$180,001 + $61,200 + 45%

Tax-Free Threshold

The tax-free threshold is not available to non-residents of Australia.

Late filing penalties

You may receive a Failure To Lodge (FTL) on time penalty if you do not lodge on time.

Tax filing obligations for Australian expats:

Australian rental income & bank accounts

Australian bank interest – you need to register with your bank as a non-resident to ensure 10% withholding tax is withheld from your bank interest received which will avoid the need to prepare an Australian Tax Return.

Investment/Rental property – should you be in receipt of rental income from an Australian land or property you will need to report the income received and expenses incurred.

Capital gains tax (CGT)

Taxable Australian property will remain tax in Australia either as a tax resident or non-resident of Australia.

Dividends

Non Australian taxable property will remain taxable in Australia as non-resident of Australia if you apply the deeming provisions otherwise they may be taxable in the overseas countries of resident by virtue of the double taxation agreement between the two countries.

Super fund contributions

You can continue to make superannuation contributions as a non-resident of Australia however, you may be worth obtaining professional financial advice before doing so as to what this may mean in the event of you not returning to Australia.

Australian expat tax deductions and exemptions

Claiming a deduction for a work related expense:

- You must have spent the money personally and have not be reimbursed by your employer

- The expense must be directly related to earning your income

- You must provide a receipt

Such expenses can include:

- Union fees

- Professional courses

- Reference books

- Tools & equipment

- Motor vehicle

- Working from home

Superannuation Contributions

You may be eligible to claim a deduction for additional superannuation contributions paid on the basis that you have sufficient unused contribution limits to be used and you have provided a notice of intent to your superannuation fund.

Tax Losses

You can continue to make superannuation contributions as a non-resident of Australia however, you may be worth obtaining professional financial advice before doing so as to what this may mean in the event of you not returning to Australia.

Returning to the Australia – important considerations

In the event of your return to Australia it is important that you obtain professional advice to assist you in determining what is the effective date that you may resume your tax residency and the impact this may have on your worldwide income.

You would need to ensure that your overseas affairs are closed off and you have an effective date of ceasing to be a tax resident in the overseas country.

Any income that is due to you has been paid to you prior to your departure and arrival in Australia to avoid paying tax in Australia.

Frequently Asked Questions

You can apply via the ATO website.

The filing deadline will vary depending of whether you are lodging the tax return yourself of via a registered tax agent:

Lodging yourself the filing deadline is 31 October.

Lodging via a tax agent the filing deadline is May the following year, if all your prior year tax returns have been lodged on time.

Any taxable income paid in the country of residency will be available as a tax offset against your Australian tax liability.

You will continue to file an Australian tax Return as a non-resident to report any Australian sourced income and overseas income in the event of an outstanding HELP debt.

Once the financial year has passed you can lodge an electronic submission of your tax return otherwise you can lodge a paper submission shortly after your departure from Australia. The processing times are longer than an electronic submission.

Yes, if you are in receipt of Australian sourced income or have an outstanding HELP/SFSS debt.

As a non-resident no however, if you are considered a tax resident then your overseas income may be taxable in Australia.

Your citizenship does not affect your tax position.

Australian expat tax advice & returns

If you have left or are leaving Australia and would like a fixed fee proposal from a firm of UK & Australian tax advisors that understands the issues affecting individuals living overseas please complete our online enquiry via our contact us button or by calling a GM Tax office closest to you.

GM Tax also offers the following Australian tax services:

GM Tax also offers the following Australian tax services:

- Tax planning advice and guidance with regards to your Australian residency status or change in visa status.

- Preparation of Australian tax returns, with all returns submitted to the ATO electronically.

- Advice on the income & capital gains tax position where a property in Australia is being let or sold while a taxpayer is living overseas.

- Impact of ceasing to be an Australian Tax Resident and capital gains tax deeming provisions.

- HECS/HELP reporting obligations as a non-resident of Australia in receipt of foreign sourced income.

- Assistance to ensure Australian sourced income of those who are non-residents of Australia is properly taxed and is not taxed twice, or double taxed.

- This last point is particularly relevant to those who have Australian sourced income or capital gains which may also be subject to tax in the country in which the taxpayer is now resident.